Federal Reserve Open Committee Meeting Days, like today, can be quite volatile. Many traders take the day off. I like Fed Days. Our method of trading is particularly well-suited for days in which volatility expands. When the markets are active, the indications of buying and selling become clear.

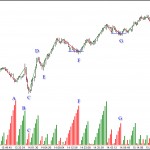

Just before the Fed announcement, the market (S&P e-minis) pushed down. There was a lot of activity in the hour or so before the announcement. You can see this activity in the Weis Wave volumes marked as A and B. More volume means more activity. This is what we expect on a significant Fed Day and gives us a “heads-up” that the market will move after the Fed announcement.

Just before the Fed announcement, the market (S&P e-minis) pushed down. There was a lot of activity in the hour or so before the announcement. You can see this activity in the Weis Wave volumes marked as A and B. More volume means more activity. This is what we expect on a significant Fed Day and gives us a “heads-up” that the market will move after the Fed announcement.

We see the price begin to gyrate with wide ranges both up and down at the announcement — typical behavior. Here is where patience is a virtue. You want to wait for the right conditions; otherwise you are likely to be whipsawed in the higher volatility. Note the low at C and the very low Weis Wave volume. That’s our cue. We trade long as the market turns up and flips the Weis Wave up.

If you didn’t see the lack of selling on the lows, that was OK. There were plenty of other opportunities to go long today. The strong rally up at D was followed by a low volume pullback at E for a choice long trade. Lots of volume on the way down to F but price doesn’t respond much. A good spot to buy in. And a Spring at G that gets tested said excellent odds for continued higher prices. Understanding the buying and the selling, waves, pullbacks and Springs make for a great day when volatility expands like it did today.

Leave a Reply