Happy Halloween!

In our part of the world where the leaves are ablaze with fall colors, there are all kinds of signs of Halloween. Pumpkins on every door-step, witches and other scary figures dot the lawns in our neighborhood, and children going to school this morning in their Halloween costumes. It’s always a fun time of the year marking the final transition from summer into winter, with the holiday season right around the corner.

In our part of the world where the leaves are ablaze with fall colors, there are all kinds of signs of Halloween. Pumpkins on every door-step, witches and other scary figures dot the lawns in our neighborhood, and children going to school this morning in their Halloween costumes. It’s always a fun time of the year marking the final transition from summer into winter, with the holiday season right around the corner.

It seems like the market is buoyed by the Halloween spirit, too. Perhaps traders are thinking about all the candy they will be able to eat tonight! Who knows. Whatever the case, the market has been rallying. We have a new all-time high in the S&P e-minis made in the Asian session.

to eat tonight! Who knows. Whatever the case, the market has been rallying. We have a new all-time high in the S&P e-minis made in the Asian session.

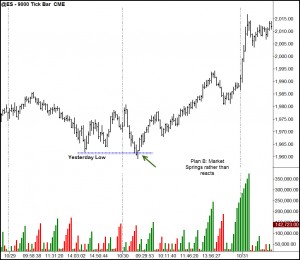

In the last post, I was thinking the market was vulnerable to a pullback and we could see price dip a bit (though not by too much). My “Plan A” didn’t occur. “Plan B” happened instead, which we were prepared for. Plan B called for a spring of the prior day’s low or holding a higher low, indicating higher prices.

We are reminded  of the power of a V-Spike reversal, which occurred at the recent lows of October 15-16. When a Wyckoff spring occurs off a V-Spike, we take notice and shift our bias. We always want to be mentally flexible and trade with an open mind. For more of this valuable mental asset, see this recent post: When Your Analysis is Wrong – A Lesson in Trading Psychology. Have a great Halloween!

of the power of a V-Spike reversal, which occurred at the recent lows of October 15-16. When a Wyckoff spring occurs off a V-Spike, we take notice and shift our bias. We always want to be mentally flexible and trade with an open mind. For more of this valuable mental asset, see this recent post: When Your Analysis is Wrong – A Lesson in Trading Psychology. Have a great Halloween!

Leave a Reply