Last night, I said in this post that if the market could hold it’s gains from Friday–perhaps test Friday afternoon’s lows and hold, we would look for the market to push higher. Friday afternoon’s lows were an important level that needed to hold for the market to rally higher.

This level did not hold. In the overnight session, the S&Ps made new highs, but could not hold them. When we came in this morning, it was clear the buyers had lost their advantage – at least for the short term.

Having key levels like Friday’s high and afternoon low give us market signposts against which we can monitor the market. Had the market held above these levels, it would have indicated buyers were in control and continued to hold the market up. That was the best guess we had after Friday closed, and had the market held these levels then long opportunities would have been the correct intraday trades this morning.

When the market broke below both Friday’s high and then the afternoon lows it indicated weakness. The break of Friday’s afternoon low also painted a lower low. With such weakness, long trades were no longer appropriate. The key levels indicating strength could not be held. Sellers entered the intraday market and short trades became appropriate.

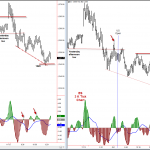

Two good shorts set up during the morning session. The first occurred just prior to the US open and was highlighted by a test of Friday afternoon’s lows. The 3-10 Oscillator on the 9K Tick chart portrayed the overall market weakness during this activity. The second short occurred just after 11:00 AM as an upthrust of the morning trading range and was also highlighted by the 3-10 Oscillator.

I also mentioned in last night’s post that the 1245 level would offer some support should the market fall today. The morning downdraft stopped at this level and was a good spot to cover shorts taken earlier.

——————————————

Traders often ask me about the 3-10 Oscillator and how useful it really is. Although very simple, it is a solid tool when you know how to use it. Market structure will always trump the Oscillator, but when you can pair structure and the Oscillator readings with one another, you get good, clear signals as we did this morning. You can learn more about the proper way to use this momentum tool at this link: 3-10 Oscillator.

Leave a Reply