Holiday Trading

Some traders tell me that they don’t like to trade during holiday weeks because the markets don’t move that much. That was probably true in years past, but there are more and more participants each year, many from outside the US. These traders are having their impact on the volume and activity of the markets. This trend is giving us better opportunities in the liquid markets during the Thanksgiving Holiday week. We’ll look at a few liquid markets.

S&Ps

In the S&P e-minis (ES), we had a very nice UpThrust occur on Monday, November 25. This occurs after weakness entered the market via a Buying Climax in the Asian session — note the low, low volume on that drive up! We have discussed in Deep Practice how to evaluate price and volume in the overnight markets, and this was a prime example. We take the UT as a matter of course and target profit objective logically.

In the S&P e-minis (ES), we had a very nice UpThrust occur on Monday, November 25. This occurs after weakness entered the market via a Buying Climax in the Asian session — note the low, low volume on that drive up! We have discussed in Deep Practice how to evaluate price and volume in the overnight markets, and this was a prime example. We take the UT as a matter of course and target profit objective logically.

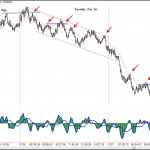

Crude Oil

Tuesday saw an UT of the prior day’s high in Crude Oil (CL). UTs of daily highs can often be significant, depending on market structure. We emphasize structure in our trading (see Chart Reading Mastery) and here it set up a good move down. We see this UT get tested and then start a two-day fall. 3-10 Oscillator trades and two other UTs offer solid trade entry locations.

Tuesday saw an UT of the prior day’s high in Crude Oil (CL). UTs of daily highs can often be significant, depending on market structure. We emphasize structure in our trading (see Chart Reading Mastery) and here it set up a good move down. We see this UT get tested and then start a two-day fall. 3-10 Oscillator trades and two other UTs offer solid trade entry locations.

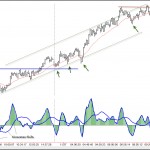

British Pound

The British Pound had the opposite structure. Starting in the Asian session today and carrying through London/Europe and the early morning of the US session, we have nice 3-10 trades until the market becomes overbought. An UT marks the end of the uptrend for now.

The British Pound had the opposite structure. Starting in the Asian session today and carrying through London/Europe and the early morning of the US session, we have nice 3-10 trades until the market becomes overbought. An UT marks the end of the uptrend for now.

Black Friday

We have many of our trading and trading psychology tutorials on sale. Helen has put them at 30% off for Black Friday. This is the biggest discount ever offered. This discount can be applied to Chart Reading Mastery (recorded sessions), too! Helen says that the sale is in effect now, so you don’t have to wait until Friday if interested. Be sure to use the code Friday30 at checkout. Ends Friday midnight. You can learn more here:

Leave a Reply