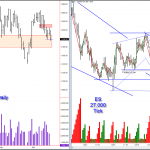

Two charts are highlighted tonight: the ES daily and 27,000 tick charts.

I mentioned in last night’s post that I expected a rally that would start off from a dip down to or below Friday’s low. That dip came in the overnight market (green arrow) and the ES rallied up nicely into the US open. I did expect the market to rally higher, but just after the US open it became apparent that a further rally wasn’t going to happen.

The sell-off today was not severe. We came back into the area of Wednesday’s and Thursday’s lows from last week. Volume was light and we closed just above Thursday’s low. Note how well-behaved the market is on the intraday, 27000 tick chart. You can also see that although the daily bar closed poorly and looks negative, the Weis Wave on the tick chart is showing a drying up of volume on today’s push down. This is an important clue as to what we might anticipate the market to do next.

In the bigger picture, we are still in the large rotational area that extends back to April. It continues to act as support. Given the structure and the wave volume, I am anticipating another rally to unfold tomorrow.

Gary,

Would it be accurate to say that it was a spring on the 27K chart, but not a daily spring?

Also, when you see a spring on a large time frame, will you just take the trade, or are you looking for some kind of confirmation on a lower time frame? For example, on the 27K tick chart would you want to see the trend change to higher highs and higher lows on a 3000 tick chart before going long? It would most likely increase risk because of the distance from the danger point, but it is psychologically difficult to enter a long trade when one could say its trending down. I guess that is what understanding the structure is all about.

David

Hi David,

This was a 27 K Tick Spring. It was not a choice Spring on the daily time frame.

Whether you take the Spring near the danger point or wait for further confirmation depends on your trading plan. Decide how you want to trade it and stick with that. You can do well either way, but you will miss some Springs awaiting confirmation. And, yes, it is psychologically more demanding to take the Spring early. But keep in mind that often the best trades are what most find challenging to do.