Stock Market Analysis: Friday’s Trading Action

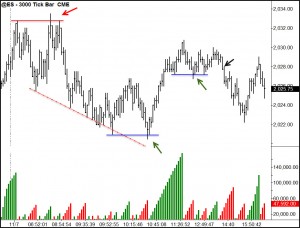

In last week’s stock market analysis, we expected to end on a positive note and we did. The week closed on a new high. Prior to Friday’s trading, we indicated that support would likely come in around the 1220 level, and we saw the market make its low of the day at 1220.50. This low set up a solid Wyckoff Spring trade (lower green arrow) that ran for about 10 points. Another spring trade set up on the pullback from the US morning session high (upper green arrow), but this one did not work out. Traders would have exited at the black arrow for a scratch or very small loss, depending on entry. We were looking for resistance to materialize around 1240, but the market never reached that level. It did provide a nice upthrust and test of the Asian session high, which also ran for 7-10 points depending on the exit. All-in-all a good trading day.

In last week’s stock market analysis, we expected to end on a positive note and we did. The week closed on a new high. Prior to Friday’s trading, we indicated that support would likely come in around the 1220 level, and we saw the market make its low of the day at 1220.50. This low set up a solid Wyckoff Spring trade (lower green arrow) that ran for about 10 points. Another spring trade set up on the pullback from the US morning session high (upper green arrow), but this one did not work out. Traders would have exited at the black arrow for a scratch or very small loss, depending on entry. We were looking for resistance to materialize around 1240, but the market never reached that level. It did provide a nice upthrust and test of the Asian session high, which also ran for 7-10 points depending on the exit. All-in-all a good trading day.

Stock Market Analysis: What’s Up Next?

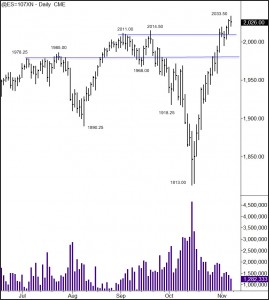

In our stock market analysis for next week we note that Friday closed under Thursday’s high and close, signaling potential weakness. For Monday, watch the area between 2030 and Friday’s high  (2033.50). The market may struggle here and offer a short opportunity. If the market can push through Friday’s high, it will likely run into resistance around 2038-40. Any pullback on Monday should find support around the 2010 area, perhaps a point or two lower.

(2033.50). The market may struggle here and offer a short opportunity. If the market can push through Friday’s high, it will likely run into resistance around 2038-40. Any pullback on Monday should find support around the 2010 area, perhaps a point or two lower.

The stock market (represented by the S&P futures) could face a larger pullback this week. I note that last week didn’t see as much progress to the upside as the previous two weeks and the Nasdaq is lagging behind both the Dow and the S&Ps. If the Naz doesn’t rally, it could pull the other indices down. Should we get a larger pullback this week, look for support to come in around 1975-80. If the market gets a good head of steam going to the downside and pushes through 1975, however, it could go as low as 1960-55.

Wyckoff Springs & UpThrusts

Springs and UpThrusts are the ‘bread & butter’ of Wyckoff trading. These are high odds trades in the right market settings, occur frequently throughout the week on all the major trading markets (CL, GC, EC, BP, ES, YM, NQ, TY), and typically move into profit right away or after a test. Friday’s trading, for example, had an UpThrust and two Springs. The UpThrust and one Spring were tested and the other spring took off right away. Not every Spring and UpThrust work out, of course. Those that don’t usually give you an opportunity to exit gracefully (i.e., a scratch or without much of a loss). These are great trade setups. If you would like all the details of trading these two setups, you can check out our video tutorials that run over 90 minutes for each trade. We go into great detail on how to identify and trade these terrific opportunities. Click on these links for more information:

Free Webinar

Dr. Gary will be holding a free webinar on Wyckoff Principles in stock market analysis and trading on Wednesday, November 19th. Come spend a half hour and learn how time-tested Wyckoff principles that are proven every day help you see the true picture of supply and demand. You will come away with relevant and useful knowledge you can immediately apply to your own trading. More information and registration may be found here:

Leave a Reply