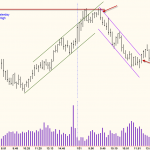

Yesterday, I noted in last night’s blog post about the Stock Market that the market was weak. It had closed down three days and there was no sign that the pullback was over. I also suggested that traders pay attention to the trading around yesterday’s high. Those who saw the up thrust early in the US session and took a short had a great trade.

The 9,000 Tick Chart highlighted the overbought market at yesterday’s high area. Less than two points above yesterday’s high was a swing high which served as the resistance target to stop the market. Chart Reading Mastery students would see all the key elements of this trade setup clearly. The market falls in a well-behaved manner into the noon hour when we expect a counter trend move.

In the upthrust course , the chart labelled “No” the price broke above the downtrend line and then formed an UT, which you said should not be shorted. This look very much like the setup “power sell” Please explain the main differences in these two setups. Thanks.

Tradervic888

Hi Victor,

Dmitry has explained it very well. (Thanks, Dmitry!)

This was a choice UT that came up against yesterday’s high. Supply was evident on the reaction, and the rally up the following morning quickly became overbought shortly after the open. You can also see the selling or supply evident when the market became overbought just prior to the US open, and again just before 10:00 AM Eastern Time.

We go over trade details like this (and more) in our weekly Deep Practice program. We spend a lot of time and discussion about key reference levels like yesterday’s highs and what to look for in sound trade setups like this one. Traders looking to build their skills can join at any time and will automatically get access to the previous four weeks of Deep Practice sessions as part of their subscription. We usually run over an hour each week for a low cost. You can learn more here: http://www.tradingpsychologyedge.com/deep-practice-with-dr-gary/

Hi Victor!

I know you ask Gary. But may be my 50 cents help you too.

This UT in ES is pretty obvious. You have the large top, very clear long resistance line. And in fact Gary’s enter was on retest of this longer-term UT. This retest also separately was another UT.

Also look at the left. You see obvious and tremendous supply with ease of movement from the yesterday high. This is very bearish behaviour. And now we test this supply area.

Plus, you see that we in oversold position with lines confluence. And top reversal bar at the UT. And the retest of this longer-term UT was on narrowing and sluggish price bars.

It is pretty obvious setup.

P.S. Broken demand line in the downtrend not necessarily mean that you should not short UT. The true reason: if you have demand then you should ignore UT. That’s why Gary not shorted it.

You should trade this setup many many monthes to make your own library of mistakes (and analyse them!), then you will get idea how to deal with this stuff! There are no shortcut way.

I made a mistake in the words. Little correction:

“oversold”=overbought

“demand line”=supply line

Victor, I reccomend you Gary’s Spring Setup course (and his ALL other products. I don’t think that you will find anything better in the intertnet. Really!). It will give you additional understanding.