3-10 Oscillator

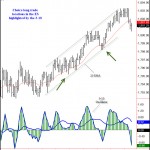

In Thursday’s Deep Practice session, one of the members asked about using the 3-10 Oscillator. It is a tool that I have used for over a decade. You don’t need to use it, everything can be seen in the chart, but it can be helpful in various situations.

I like to use it in conjunction with a 20-period moving average. I use the EMA, but a SMA will work just as well. When momentum comes into the market, we look for a pullback in the oscillator. Price typically comes back to around the MA, which is our measure of central tendency and serves as a substitute trend line. You can get some very nice trades setting up with this simple tool and we see two well-depicted areas for long trades that occurred on Friday (green arrows). These two trades would have netted about 7-8 points up to about 12 points, depending on how they were traded. I did a tutorial on the 3-10 showing this and several other choice setups you can find here: 3-10 Video Tutorial along with ten days of trading it in the ES.

I like to use it in conjunction with a 20-period moving average. I use the EMA, but a SMA will work just as well. When momentum comes into the market, we look for a pullback in the oscillator. Price typically comes back to around the MA, which is our measure of central tendency and serves as a substitute trend line. You can get some very nice trades setting up with this simple tool and we see two well-depicted areas for long trades that occurred on Friday (green arrows). These two trades would have netted about 7-8 points up to about 12 points, depending on how they were traded. I did a tutorial on the 3-10 showing this and several other choice setups you can find here: 3-10 Video Tutorial along with ten days of trading it in the ES.

Black Friday

Several traders in our community asked for “Black Friday” specials on our products. Black Friday is the traditional start of the Christmas shopping season in the US and most all stores now have a sale on this day. Black Friday is November 29 and Helen has set up a special discount of 30% for this one day only. If you are interested, you can take advantage of the discount at this link: Black Friday Special – Nov. 29th Only

More on the 3-10

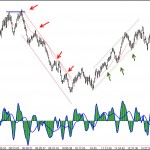

Crude oil had a text-book day for the 3-10 on Friday. The day began with an UpThrust early in the American session, traded down, then turned around and began rallying up. You can see by this tool that it really isn’t necessary to pick the top or the bottom. (Use the Wyckoff UT and Spring for that). If you are sensitive to momentum (which is what the 3-10 measures) you have ample opportunities every day watching just two or three markets.

Crude oil had a text-book day for the 3-10 on Friday. The day began with an UpThrust early in the American session, traded down, then turned around and began rallying up. You can see by this tool that it really isn’t necessary to pick the top or the bottom. (Use the Wyckoff UT and Spring for that). If you are sensitive to momentum (which is what the 3-10 measures) you have ample opportunities every day watching just two or three markets.

Leave a Reply