Last week produced a fairly narrow range of trading. The first three days of the week saw low volatility, while Thursday and Friday saw activity pick up. Despite the end of the week jump in trading activity, only the Dow pushed above last week’s highs.

Comparative Strength & Weakness: Current Market

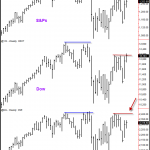

The chart for this post is a weekly chart of the S&Ps, Dow, and Nasdaq futures markets. In applying the Wyckoff Method, we pay attention to the comparative strength and weakness of related markets.

Here, you can see that the Dow managed only a slight new high last week. After six straight days of trading, the S&Ps made no net progress (see daily chart, not shown). It’s the same for the Nasdaq. This can mean that demand has tired, or, alternatively as there is a supply area to the left in both of these markets, it could mean that the markets are attempting to absorb that supply in anticipation of higher prices in the near future. At this stage, it is difficult to tell which is more likely to be occurring.

One clue may be found in the comparative strength or weakness among the three markets. Compared to the Dow, both the ES and especially the NQ closed the week some distance away from recent highs. You can also see that the Naz had been stronger going into the end of October, but has since become weaker.

A Recent Example

We had a similar situation as this develop last July (highlighted by the blue horizontal lines). In that case, it was the Dow that was lagging and the Naz that was attempting to pull the markets higher. The disconnect led to a rather dramatic sell-off.

Circumstances today are unquestionably different than they were in July. For one thing, there seems to be more anxiety about Europe lately. For another, even though the Nasdaq was reaching for higher prices last July, it was also displaying clear shortening of the thrust after a lengthy up move. Also, the seasonal bias in July was the opposite of what it is approaching the holidays. Nevertheless, it is worth being aware of the present chart situation.

How to Apply this Information

Keep an eye on the Naz. If we continue to rally and approach the 1283.50 high (basis ESH12) this week and the Naz continues to substantially lag, it can mean difficulty for the S&Ps at that level. On the other hand, if the Naz “catches up” and becomes more in sync with the Dow, then a push to and possibly through 1283.50 is more likely.

If the current rally fails and we stall or upthrust the most recent 1266 high or fall below last week’s lows, it will be the Naz that leads us down.

Volatility & the FOMC

Keep in mind that we have the FOMC meeting announcement on Tuesday afternoon. Given the narrowness of last week’s range, we would be anticipating an increase in volatility this week and the Fed announcement may be the trigger.

Leave a Reply