Trading price and volume—or any method, for that matter—is definitely difficult when the market sees volatility contract. We have been seeing volatility contract in the S&Ps recently.

Trading Price and Volume in the S&Ps Today

Trading the S&Ps today had its challenges. The Asian session had the best setup when the market failed to continue lower after penetrating the 2-day low (#1). Note that price and volume were helpful here. Price fell swiftly down into key support but with no supporting volume. A nice setup.

Trading the S&Ps today had its challenges. The Asian session had the best setup when the market failed to continue lower after penetrating the 2-day low (#1). Note that price and volume were helpful here. Price fell swiftly down into key support but with no supporting volume. A nice setup.

All that came next was essentially choppiness—the hallmark characteristic of low volatility—into yesterday’s high. Frankly, I was looking for an upthrust and missed getting short (at #2). Fortunately, the oversold position and increased demand allowed for a day-saving trade (#3).

Trading Price and Volume For Tomorrow

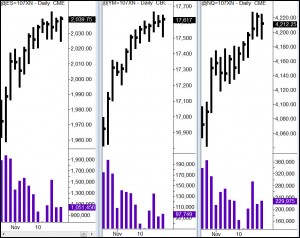

We are in a fairly tight range framed by the high and low of the last three days. Volume came in last Thursday causing the market to falter, and we are still trading within that day’s  range. Watch for the breakout of this range. As you do, keep an eye on the Naz. Although the S&Ps and Dow closed strong today, the NQ was a bit off. See how this market acts next. It could give us an early clue as to the direction of the market’s next move.

range. Watch for the breakout of this range. As you do, keep an eye on the Naz. Although the S&Ps and Dow closed strong today, the NQ was a bit off. See how this market acts next. It could give us an early clue as to the direction of the market’s next move.

Free Webinar on Trading Price and Volume Wednesday

We are holding a free webinar on trading price and volume on Wednesday. Join us for a half hour or so and we will review Wyckoff principles in the S&Ps, Euro FX, Crude Oil and Gold. We will look at what’s next in some of these markets, as well. It will be fun and you should come a way having learned something useful for your trading—a half-hour well-spent. Learn more here:

Leave a Reply