Overview: Trading the S&Ps After the Holiday

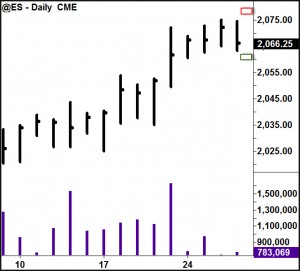

Trading the S&Ps after the holiday can present its own challenges and this year is no different. The charts this week show an interesting pattern. Although we are in a bullish holiday period, the monthly and weekly are both a bit overbought. We can expect a pullback on these time frames at some point. The daily is starting to go sideways, indicating some early stage congestion action. Note that demand has dropped off after some selling came in (last Friday, November 21st). Key resistance early this week will be in the 2078-2082 area. If price stays contained within that level and the daily goes into a sideways line, we could potentially see a larger pullback, back to about the 2050 level initially, and perhaps down to the 2035 level if a down move gets going. I think, though, that a pullback—if it does come—is more likely to occur later in the week after the daily has started to create a sideways line.

For Monday’s Trading the S&Ps After the Holiday

Watch the trading around last week’s low (2060.75) carefully, especially if price goes there early in Monday’s trading. I will be looking for support to come in at that level, perhaps a little higher (2062-64) for a spring or test of Friday’s low. Look for any rally up on Monday to find difficulty around 2078. If price moves to that level early in Monday’s trading, it could present an opportunity for a short. As always, pay attention to price action and volume in these key areas, as that will tell you whether an area of projected support or resistance is likely to hold at that point.

Watch the trading around last week’s low (2060.75) carefully, especially if price goes there early in Monday’s trading. I will be looking for support to come in at that level, perhaps a little higher (2062-64) for a spring or test of Friday’s low. Look for any rally up on Monday to find difficulty around 2078. If price moves to that level early in Monday’s trading, it could present an opportunity for a short. As always, pay attention to price action and volume in these key areas, as that will tell you whether an area of projected support or resistance is likely to hold at that point.

Website Sale

We are having our biggest sale of the year through Cyber Monday. We had not done this in the past until several in our community asked for a Black Friday/Cyber Monday sale. It is a good time to purchase one or more of our video tutorials as this is the lowest price at which we offer them. You can even get our highly rated Chart Reading Mastery at a deep discount. Use the coupon NewWebiste30 for a savings of 30% off any professional-level trading video tutorial. This includes our acclaimed tutorials on trade setups like the Spring & UpThrust, how to read price and volume alone (the Primary Language of the Markets), Trading the Trend, and all of our trading psychology tutorials. The only exclusions are the Weis Wave and Deep Practice. So take advantage of the deep discount as it all ends on Monday night. Here is a link to all our tutorials:

Leave a Reply