Tomorrow night David Weis will be teaching his terrific adaptation of Richard Wyckoff’s Wave & Tape Reading Charts, known as the Weis Wave. David, a 40-year student and master of the Wyckoff Method, has taken Wyckoff’s work and adapted it to the modern markets. And what an adaptation it is! Hands down, David’s Wave Chart is the most valuable trading tool I know. More on this later … Let’s first take a look at how it worked in today’s ES market:

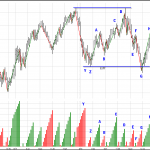

Coming into the market we knew that supply had entered from various indications yesterday (see this post by clicking here). Rather than continue down, however, the market met support at the key 1177 level where active trading had either halted the market at this level (as on 8/9 & 8/10) or supported the market at this level (as on 8/15). See a daily chart (not shown). The light down wave volume and price behavior at Z indicated that this level would likely hold.

Wave A – We see a strong pre-US Open rally. Buyers have returned despite yesterday’s supply.

Wave B – a smaller amount of downside selling. We want to be buyers in this area.

Wave C – Longs are rewarded as buyers push prices higher.

Wave D – The volume tells us this is most likely a test; price action indicates sellers have stepped in.

Wave E – The largest downside volume seen today. Time to think about shorting this market.

Wave F – A weak rally. Look at the wave volume! Pretty clear location for a short trade. (Those using the Momentum Oscillator may now see how valuable combining David’s Wave chart with that tool can be for some incredible trading.)

Wave G – a good run down to the key 1177 level. Compare the wave volume between this wave (G) and the Wave Y from yesterday. Skilled Weis Wave traders cover shorts here and reverse on this Spring.

Wave H – A nice response to the Spring on good wave volume.

Wave I – Not much supply, but the next up wave shows demand weakening into the close. Exit longs.

Richard Wyckoff strongly emphasized that traders need to understand the market waves in order to trade well. David Weis has taken this to heart and developed a wonderful tool for traders to follow Wyckoff’s sage advice. From the past several posts, you can certainly see how useful reading the waves can be.

There is less than 24-hours to register for David’s training and TradeStation Plug-in. You can see many more examples of trades across several different markets (including FX) and time frames at this link that follows. Start trading with David’s Weis Wave and combine classic Wyckoff trading as adapted for the highly active, modern electronic markets: Weis Wave Webinar & Plug-In

Gary;

Good luck with the webinar tonight.

Sorry I couldn’t participate; perhaps sometime in the future either I’ll change platforms, from Ninja Trader to TradeStation, or code could be written for Ninja Trader.

If David were willing to allow it, I wonder what the cost would be to have the code in NT?

I’m sure that the Weis Wave is everything that your advertising it to be.

Thank goodness there are versions of the 3-10 for NT.

I had taken a (2+) year layoff from trading “live” in the market. Through your insightful training/mentoring with a combination of your Chart Reading series, the weekly Deep Practice sessions, combined with the 3-10, I began “getting my toes wet” starting last week.

I must report that my initial results have been nothing short of spectacular. Mind you, I’m taking little steps, in order to build my confidence, but the clarity is amazing.

I’m developing a strong foundation in which to build upon, and the credit for my initial trading success goes to you.

Thank you,

Respectfully,

Stan

Hi Sam,

I’m glad to hear you are doing well. I’m not surprised, really, as I can tell from your comments and questions in Deep Practice that you are “getting it.” Just keep working on making incremental progress. No need to try for big leaps – that is a fool’s game. Go slow and steady.

We do have good news on the Ninja Trader front: one member from our community is skilled in coding for that platform. He is working directly with David to develop a Ninja version. We will let you know when it becomes available.

And, yes, David’s indicator is that good, if you know how to use it.