The Wyckoff Spring is difficult to trade when the market is falling like it did today,” wrote one trader in an email after the close. He asked, “How do you do it?”

The Wyckoff Spring is one of my “bread & butter” trades. I look for them all the time. In the few markets I trade, I know there will be at least 2-3 Wyckoff Springs setting up each week in each market. It’s a trade I count on.

Wyckoff Spring: What To Look For

Here are a few things we can see in yesterday’s Wyckoff Spring that helped us determine is was a solid setup (not all will be).

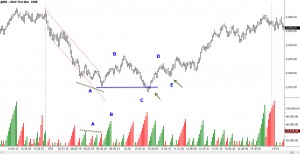

First, selling is drying up as price pushes lower. We see this at A.

First, selling is drying up as price pushes lower. We see this at A.

Next, we see demand show itself with good volume and a sizable wave at B. Note the downtrend line is also broken.

Supply comes out on the way down to retest the lows at C, but not much progress is made. Lots of selling there, but buyers are very active, too. They aren’t letting the market fall. Even though the markets is falling, this action is bullish. The aggressive trader makes a play here with small risk.

We now want to see demand exert itself and the push up to D shows this nicely. We want to be a step ahead of the market by knowing what to look for next. This is anticipation. Most traders at this point would be predicting higher prices. We anticipate them, and there is a substantial difference. Anticipation is a much more mentally flexible approach that allows us to confirm we are correct in trading the spring or disconfirm that the spring is happening. Either way, we are not mentally locked into price going in a specific direction or to a specific level. By anticipating, we remain mentally flexible and can act correctly, no matter what the market does. In this case, our assumptions are confirmed. A second trade location is offered as the market pulls back on lowered volume, further confirming that the tone of the market has changed to a bullish one. Here at E the more conservative trader makes a very nice play and the aggressive trader adds to her position.

So even though the market was falling, it was not that difficult to see buying was overcoming the selling, if you understand what to look for.

Wyckoff Spring: Learn More

There is much more to learn about this wonderful trade, of course. I can’t detail everything in a blog post. I’ve put all that I know about trading the Wyckoff Spring in a 90-minute video tutorial. It’s highly rated by traders and goes into great depth on how to trade the Wyckoff Spring. This trade occurs frequently in all markets and time frames. It’s a true bread & butter trade. So, give yourself a nice early holiday gift. You’ll be glad you did. Learn more here: Trading the Wyckoff Spring.

Leave a Reply