I’ve posted two charts of the S&Ps tonight: A weekly and a daily chart.

Weekly Chart

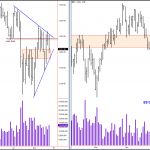

The weekly chart is forming an obvious apex. Presently, price is between the resistance of the June lows (red line) and the rotation area we have been talking about for the the past few days (orange box). When a market forms an apex, it signifies that volatility has contracted and that buyers and sellers are more-or-less in a state of equilibrium.

The relatively quiet trading won’t last long, however. We pay attention to apexes because these are points at which we can anticipate trading activity to increase and for the market to move strongly either up or down, out of the confines of the apex.

The likelihood that the market will move strongly out of the apex is reinforced by the two areas highlighted in the chart. If the market is to move up, it must overcome the resistance of the June lows and the immediate overhead supply building from late October. If it is to move down, it must drive through the large Axis area that the market has been rotating around and testing since August. To do either will require a lot of effort or force, and we should see a good move develop, once the market decides to leave the current price level.

Daily Chart

In my last post (which you can read here) I anticipated a rally but also noted that I didn’t expect too great a rally due to the resistance level highlighted on the daily chart by the red box. We did rally and we did see resistance turn the market as anticipated.

Friday’s volume was light and the range was about average. I view that as indicating no fresh selling breaking out. I’ll be watching Monday for a dip below Friday’s low. As long as it is on light-to-average volume, I’ll look for a buy opportunity for another rally up. If we do get that rally, I would anticipate it to go a little higher into the resistance area highlighted by the red box.

Leave a Reply