“Is this a Wyckoff Spring?” a trader asked about today’s trading in an email. The market fell sharply lower, then quickly rallied to close near its highs. As it did so, it created a Wyckoff Spring. The Wyckoff Spring is a setup that occurs when a market dips underneath its last swing low, turns around, and then rallies to close back above the swing low. (You can find more information about the Wyckoff Spring at this link: Wyckoff Spring). Note that the volume on the daily chart has increased. The buyers prevailed and we are off to higher prices.

“Is this a Wyckoff Spring?” a trader asked about today’s trading in an email. The market fell sharply lower, then quickly rallied to close near its highs. As it did so, it created a Wyckoff Spring. The Wyckoff Spring is a setup that occurs when a market dips underneath its last swing low, turns around, and then rallies to close back above the swing low. (You can find more information about the Wyckoff Spring at this link: Wyckoff Spring). Note that the volume on the daily chart has increased. The buyers prevailed and we are off to higher prices.

Or are we?

I don’t know yet if we are.

Wyckoff Spring Cautionary Tales

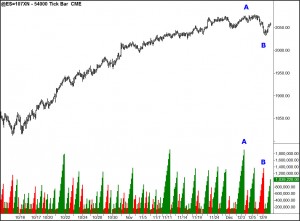

Take a look at the 54,000 Tick Chart representing the intraday action. This  chart shows the rally from the mid-October lows. Three things stand out to me: We have shortening of the thrust on the highs, a lot of volume on the run up to A that didn’t produce new highs, then a large amount of volume coming in to the downside on today’s move down (B). This combination of Wyckoff principles usually indicates a reaction is in the offing.

chart shows the rally from the mid-October lows. Three things stand out to me: We have shortening of the thrust on the highs, a lot of volume on the run up to A that didn’t produce new highs, then a large amount of volume coming in to the downside on today’s move down (B). This combination of Wyckoff principles usually indicates a reaction is in the offing.

If these cautionary tales are indeed adding up to weakness, then tomorrow look for the market to fail on any push up above today’s high (2062.25). If weakness is starting to dominate the market, the last swing low (2048.25) will be violated. That could happen tomorrow or the next day. Eventually, today’s low (2033.25) will be taken out cancelling the Wyckoff Spring.

Wyckoff Spring Igniting Buyers

If, on the other hand, today’s market is reflective of the bulls reenergizing at the morning’s lowered prices, and we have had a valid Wyckoff Spring, then we are more likely to see a testing of today’s heavy volume. Look for that test to hold at, a little above, or a little below the last swing low level (2048.25).

Any rally tomorrow that fails to be stopped at today’s high will likely run into resistance around the 2070 level.

Leave a Reply