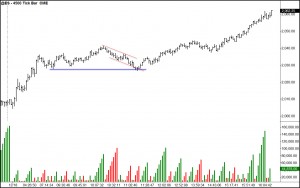

A Wyckoff Spring brought holiday cheer to the market today. Christmas came early as the first good trade against a reliable edge today lit up the market.

Wyckoff Spring Entry

After rallying above yesterday’s high and the two-day high in the overnight market, the S&Ps hit a little selling around the 10:00 AM (Eastern Time) inflection point.

After rallying above yesterday’s high and the two-day high in the overnight market, the S&Ps hit a little selling around the 10:00 AM (Eastern Time) inflection point.

The downside volume started fairly heavy, but price didn’t go very far. This was the first clue that the buying overnight would be sustained in the US session. As price came down, volume started to recede. The market on the intraday time frames became oversold and then reached support. Dipping underneath suport ever so slightly, then rebounding back up gave us the Wyckoff Spring entry.

Response to the Wyckoff Spring

We always look for an affirmative response from the Wyckoff Spring. This one gave a nice, quick response. Buyers came back to life, as seen in both the price action and volume. A brief test after pushing through the supply line gave this Wyckoff Spring a grade of A+ for being a good trade. And good trade it was. The trade ran through to the end of the day in a Trend Day Up producing 30+ points from entry.

Learning the Wyckoff Spring

The Wyckoff Spring is a favored, “bread & butter” trade. It is highly reliable in overall market conditions like today. The trade is initiated very close to the stop point (the “danger point”), so risk is low. When it is not going to work out, the market usually tells you before properly placed stops are hit, allowing you many times to scratch the trade for little or no loss. It sets up several times a week on the intraday charts. And, it forms in all markets and on all time frames. It is truly a great trade setup.

We have a 90-minute video training on this one setup. It is rated highly by traders (five stars). The video teaches you all the nuances of the trade, including times when not to take a setup and also power springs where the Wyckoff Spring not only has high odds of working, it is also likely to produce a very strong move to the upside.

You can learn more at this link:

Thanks! for such a lucid explanation of wyckoff spring.

Regards,

Nitin